The quality of our funds is built on our many years of experience and the depth of asset expertise that our specialists possess. As well as assessing potential value enhancement, our in-house professionals also actively manage assets on a continuous basis, for the full duration of the funds. Our wide-ranging expertise spans from purchasing, to marketing and proximity to assets, helping to anticipate risks early and to successfully modify investment structures.

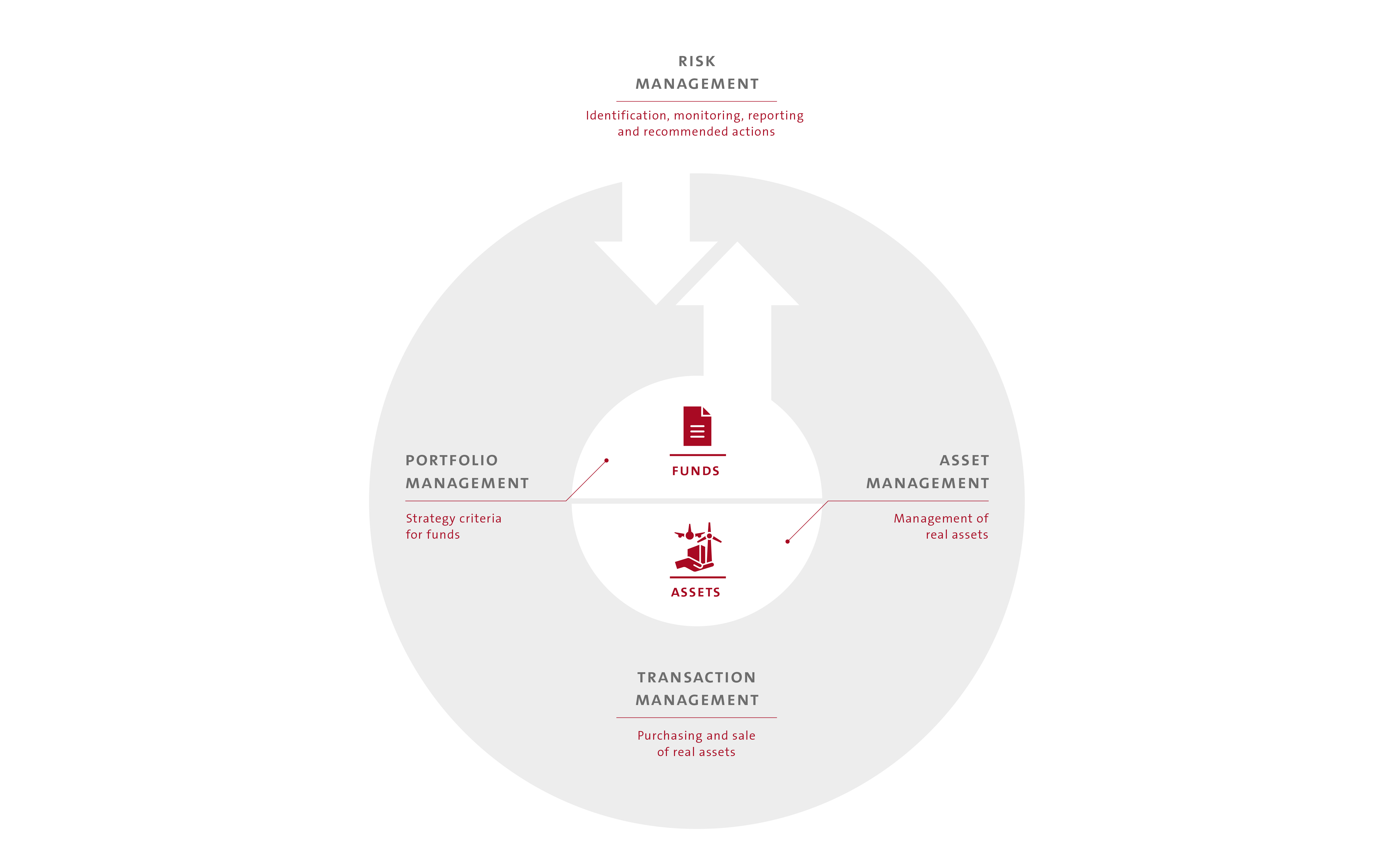

Risk Management at KGAL Investment Management GmbH & Co. KG has set up a specific risk management system designed to identify, measure and manage the relevant risks. Our risk management system supports all three management divisions through regular monitoring of key parameters at market, fund and investment level, and using the data to make specific recommendations. By discussing the topics face-to-face with transaction, asset and portfolio managers, we continue to minimise risk at all levels.

Transaction Management is responsible for the acquisition and disposition of the funds’ investment targets. Each transaction manager ensures access to the relevant markets and concludes individual transactions. They work in close collaboration with Risk Management teams, which allows them to make risk-optimised decisions.

KGAL Investment Management GmbH & Co. KG Portfolio Management defines clear strategic requirements for our funds. This function continuously monitors whether the requirements are being met in order to react to changes in the market and to actively structure the portfolio. In addition, the Portfolio Manager is the main contact person for any queries the Risk Manager may have relating to the fund:

Asset Management takes on responsibility for the professional management of real estate, aviation and energy plant operating assets, as well as their performance. The team works closely with Risk Management and individual fund portfolio management teams, supporting them in their decision-making processes. Asset Management focuses primarily on the

Failure to take high-risk trends into consideration can lead to losses, or even pose an existential threat to KGAL Investment Management GmbH & Co. KG or our fund products. As such, KGAL Investment Management GmbH & Co KG has integrated a two-dimensional, sustainability-oriented risk management system that into the existing management system, which encompasses the company as well as the fund level.

The objectives of risk management at company level include ongoing monitoring of the company’s risk-bearing ability, the limitation and avoidance of risks on the part of KGAL Investment Management GmbH & Co. KG, and the initiation of countermeasures should risk events arise.

The effects of potential risks on the company are monitored through a range of measures, including ongoing liquidity and earnings stress tests.

Regular risk reporting for management, shareholders, and auditors ensures appropriate risk transparency for the company’s executive and supervisory bodies.

When it comes to risk management at fund level, KGAL Investment Management GmbH & Co. KG focuses mainly on transparency with respect to risks that put yield and capital at risk. This is implemented at fund level using the following instruments: